Justin Bieber Sells His Music Rights For $200 Million: Is This a New Normal For Artists?

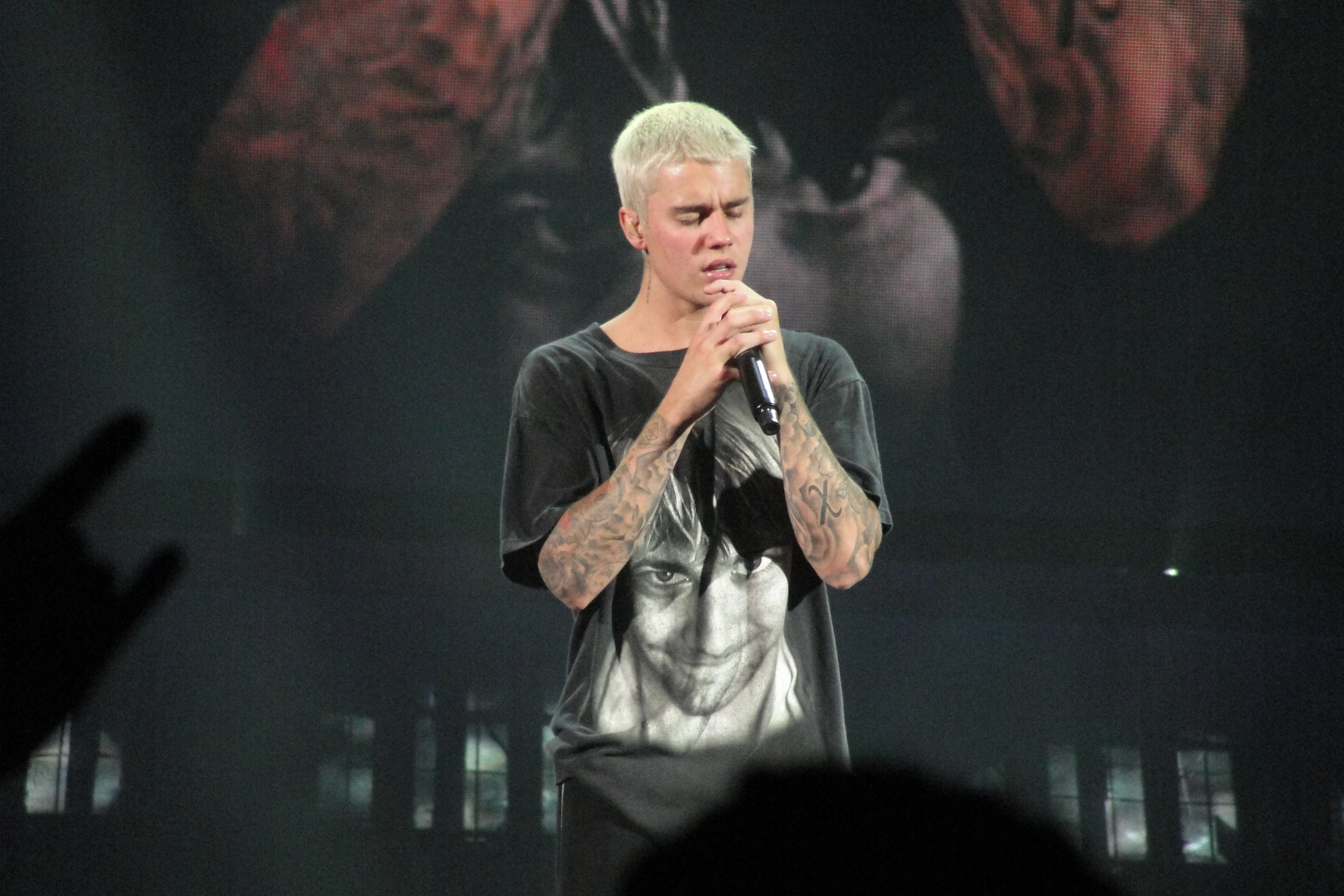

Justin Bieber pictured performing at a concert in Des Moines, Iowa 2016.\

Coop Buda, via Flickr

Everyone knows who Justin Bieber is. The multi-platinum recording artist has been at the top of the music industry for the past 13 years. However, over the past couple of years, Bieber has adopted a much more quiet, private lifestyle away from the media.

Well, Bieber’s name has been making headlines over the past few weeks after he sold the rights to all of his music to U.K.-based music investment company, Hipgnosis, for $200 million.

He follows a recent trend of renowned and incredibly popular musicians who have also signed away, either a majority of, or their entire catalog, for a heaping sum of money. The likes of these artists include Bob Dylan, Shakira, the Red Hot Chili Peppers and many more.

Some of Bieber’s biggest songs like “Baby,” “Sorry” and “Peaches,” which have garnered millions and even billions of streams, are now owned by Hipgnosis. The revenue made from streaming these songs will now go to them.

Bieber is now the youngest multi-platinum singer to sell their entire catalog, and his $200 million deal ranks as one of the most expensive ever signed.

Hipgnosis founder Merck Mercuriadis confirmed this, stating, "This acquisition ranks among the biggest deals ever made for an artist under the age of 70, such is the power of this incredible catalog that has almost 82 million monthly listeners and over 30 billion streams on Spotify alone."

Although Bieber sold his publishing rights to Hipgnosis, his masters are being held due to the fact that they are still owned by Universal Music Group. Justin Bieber owns approximately 20% of his publishing rights and artist royalties, meaning that he sold that mere 20% for a staggering $200 million.

The primary question many people have in reaction to these artists selling their percentage of their music catalog is, why? Why not continue making money under the management of corporations like Universal Music Group?

Loudwire answers these questions in their article about the recent selling of music catalogs by major artists. They explain that the answer is different for every artist, but most older artists would rather have a pile of cash to sift through when they are planning their estates, rather than a confusing amount of outlets where their money comes from. Also, it makes it easier for their heirs to inherit money because they don’t have to deal with royalty checks that are taxed.

These artists really have a hard decision. It is between their artistic integrity, where they continue relying on annuity and how popular they think they are and will continue to be, or a large amount of money.

When it comes down to it, it’s really all about the money. Not only are they selling a small portion of what they own from their catalog, but they also aren’t selling their master recordings either. It’s a win-win for artists looking to cash out.

A lot of people are questioning whether this is a new normal for artists that want to trade their catalog for a big payday. Many think it is due to tax benefits, various private reasons, and the fact that the money outright is more than the artist’s annual income from their music catalog.

According to CNN, Justin Bieber’s manager, Scooter Braun, attributed the deal made with Hipgnosis as one for “financial benefit” and to “preserve and and grow this amazing legacy that Justin has created.”

Whether that’s true or not, Bieber is still in control of his music, which is probably the most significant aspect of the deal for him. With Bieber’s deal completed, maybe we will start to see a new normal for artists who want to sell their catalog, while still keeping their artistic integrity.

Either way, the music is the most important thing and hopefully Bieber and every artist that makes one of these deals continues to grow their catalog.

Justin Bieber, once again, pictured performing at a concert in Des Moines 2016.

Coop Buda, via Flickr